Evolving Chinese Influence in Sri Lanka: India’s Concerns amid Massive Crisis Aid

- CNL Reporter

- January 18, 2025

- Weekly Economic Review

- Evolving Chinese Influence in Sri Lanka: India's Concerns amid Massive Crisis Aid

- 0 Comments

WEEKLY ECONOMIC REVIEW

Sri Lanka Navigates Strategic Rivalries and Economic Recovery

China’s approach in Sri Lanka is shifting from mega-projects to increased high-level interactions and development initiatives.

Under the new administration, restarting flows of development finance from China will be a high priority. Sri Lanka concluded restructuring its International Sovereign Bonds last month. With the exchange concluded, other partners such as Japan stepped up to confirm that they will restart the projects with Sri Lanka that had been halted as a result of sovereign default.

Neither China nor any of its policy banks has yet commented on resuming their projects or new lending commitments. Recent experience suggests that China will be more cautious in lending to Sri Lanka given the concerns pertaining to debt sustainability.

However, there is a significant amount of undisbursed balance for already committed Chinese loans, most of which were from China EXIM Bank.

Sri Lanka is set to receive its largest foreign direct investment (FDI) to date with a $3.7 billion oil refinery project spearheaded by China under the Belt and Road Initiative (BRI). This agreement, led by Sinopec, intensifies competition between China and India for influence in Sri Lanka’s energy sector. The country continues to navigate its economic recovery amidst significant debt obligations, including loans from China.

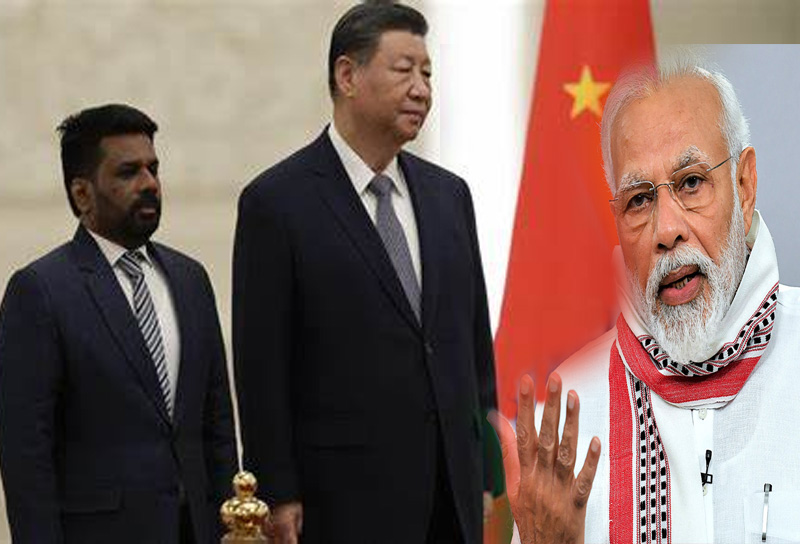

President Anura Kumara Dissanayake, elected in September 2024, visited Beijing from January 14 to 17, marking his second overseas trip since assuming office. His visit follows a prior diplomatic mission to India, emphasizing both nations’ importance to Sri Lanka’s economic agenda. While India remains Sri Lanka’s top economic partner, China’s role is pivotal in fostering investment and growth rather than accumulating further debt. Debt restructuring and investment discussions were high on the agenda during Dissanayake’s visit to China.

Political Landscape and Economic Recovery

Dissanayake’s election symbolized a public demand for change, following the resignation of Gotabaya Rajapaksa amidst nationwide protests. The National People’s Party (NPP), led by Dissanayake, broke the dominance of traditional political parties over seven decades. The NPP’s mandate includes combating corruption, holding perpetrators of the 2022 Easter attacks accountable, reducing tax burdens, and improving welfare for the underprivileged.

Despite campaign promises of renegotiating Sri Lanka’s debt, Dissanayake adhered to a prior agreement reached under the former administration. This move ended Sri Lanka’s sovereign default and restored access to global financial markets. However, accessing development finance remains crucial to achieving long-term economic growth.

Progress Toward a Sri Lanka-China Free Trade Agreement

Sri Lanka and China agreed to expedite the conclusion of a comprehensive free trade agreement (FTA) after years of delays. The FTA negotiations, stalled since 2018 due to concerns about a potential imbalance favoring China, have now regained momentum. The Export Development Board (EDB) has set ambitious targets of $18.2 billion in exports by 2025, including $4.1 billion in service exports.

In 2024, Sri Lanka’s exports totaled approximately $16.2 billion, with $13.2 billion from merchandise exports. Key sectors such as gems and jewelry, fisheries, and construction show strong growth potential, though regulatory and logistical hurdles remain. For instance, the construction industry requires larger bank guarantees to secure contracts in markets such as the Maldives, the Middle East, and Cambodia.

Regional Competition: India’s Strategic Projects

India has increased its strategic engagement with Sri Lanka, providing $4 billion in financial assistance during the 2022 economic crisis. Proposed energy projects, such as a $1.2 billion undersea power line and a fuel pipeline to Trincomalee port, signify New Delhi’s commitment to strengthening ties. This intensifying competition underscores Sri Lanka’s delicate balancing act between its two influential neighbors.

Agricultural and Industrial Performance

Sri Lanka’s agriculture sector exhibited mixed results in 2024. Tea production saw a modest year-on-year increase driven by higher demand, while rubber production improved in November despite a cumulative decline due to adverse weather earlier in the year. Coconut production, however, experienced a significant drop over the same period.

Meanwhile, manufacturing and service activities expanded in December, as reflected in the Purchasing Managers’ Indices. Tourism also showed strong recovery, with 2.05 million arrivals in 2024 compared to 1.48 million in 2023, while workers’ remittances grew to $6.5 billion from $5.9 billion the previous year.

Energy and Monetary Developments

Between January 15 and 17, 2025, global crude oil prices rose above $80 per barrel due to concerns over U.S. sanctions on Russia and declining U.S. crude stockpiles. However, optimism surrounding a potential ceasefire in Gaza tempered price hikes later in the week.

Domestically, reserve money declined, driven by reduced deposits from commercial banks at the Central Bank. Market liquidity stood at a surplus of Rs. 111.3 billion as of January 17, 2025, down from Rs. 130.3 billion the previous week. The Sri Lankan rupee depreciated by 1.3% against the U.S. dollar during the same period.

SME Relief and Financial Stability

Sri Lanka has introduced a relief package for small and medium enterprises (SMEs) in collaboration with the Central Bank, Sri Lanka Banks’ Association, and SME representatives. This initiative aims to provide breathing space for struggling SMEs while maintaining banking sector stability.

Between April 2019 and September 2024, approximately 494,000 loans worth Rs. 886 billion were classified as non-performing (Stage 3 loans), with 99% involving loans below Rs. 25 million. Given that SMEs contribute over 50% to the country’s GDP, supporting this sector is vital for economic reorientation and recovery.

Fiscal and External Sector Performance

Sri Lanka’s revenue and grants increased to Rs. 3.66 trillion in the first 11 months of 2024, compared to Rs. 2.77 trillion during the same period in 2023. Official reserves stood at $6.09 trillion. The government’s efforts to address the economic crisis and implement structural reforms continue to bear fruit, albeit with challenges.