Sri Lanka’s central bank makes Rs274bn profit in 2024

- CNL Reporter

- April 30, 2025

- Banking and Financial

- Sri Lanka’s central bank

- 0 Comments

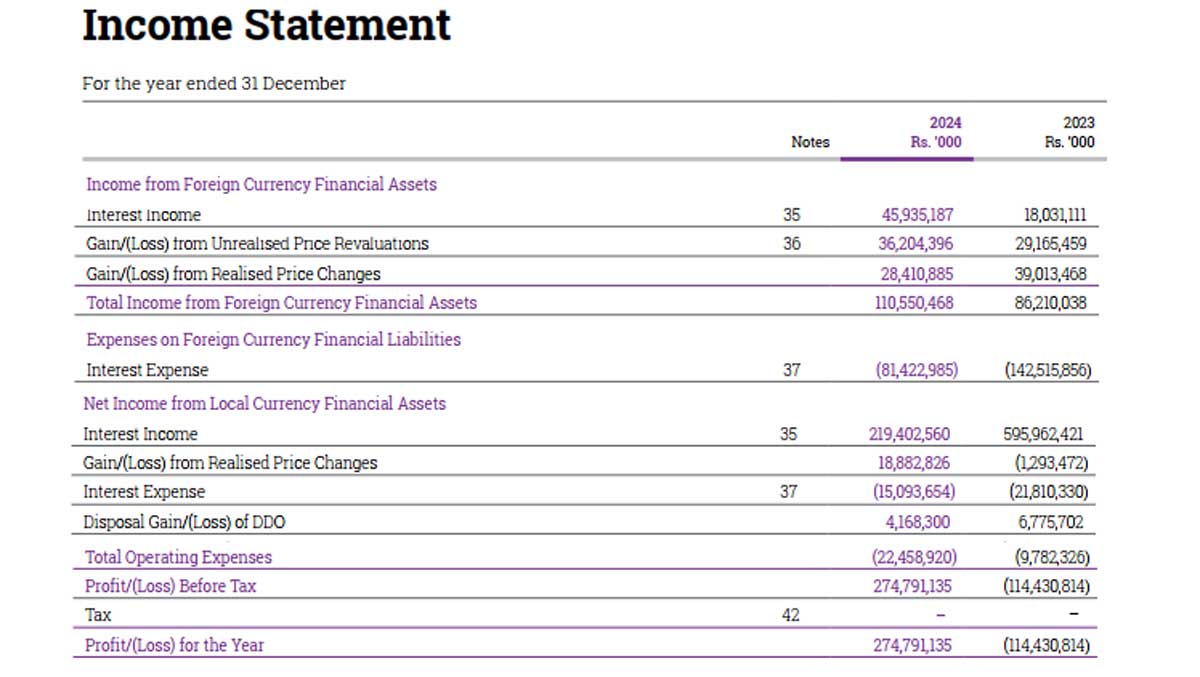

Sri Lanka’s central bank has made profits of 274 billion rupees, profit in 2024, with interest income from its bond portfolio and foreign assets, which turned positive in the year amid deflationary policy.

The central bank has booked 219 billion rupees of interest from its rupee securities portfolio, down from 595 billion rupees in 2023 when it earned high rates from Treasury bills, its annual report shows.

Domestic Assets

The central bank bought over three trillion rupees of bills (inflationary policy) to trigger a currency crisis and the eventual sovereign default from 2019 to 2022.

Some of the bills were later effectively rolled over without creating any new inflationary reserves in banks, after monetary stability was reached in September 2022.

The bills were then restructured into lower interest yielding, step down bonds to meet International Monetary Fund gross financing needs and avoid broader Ghana style restructure that prevented rates from coming down.

The restructure led to a large book loss in 2023.

The bonds are now valued in the balance sheet according to a method chosen by the bank.

In the balance sheet local currency assets were reported as 1,748 billion rupees by end December from 2,044 billion with repurchase deals of 333 billion also terminated.

“This portfolio is not an investment portfolio, as the Bank does not purchase Government Securities with the intention of earning an interest income,” the central bank said.

“The Bank purchases or sells Government Securities to inject rupee liquidity into the domestic market or to absorb liquidity from the market in the course of carrying out its monetary policy operations in relation to its core objective, maintaining economic and price stability.

“Hence, the volume of Government Securities in the Bank’s portfolio is largely determined by its monetary policy operations. Therefore, the Bank does not consider interest rate sensitivities arising from local currency assets.”

Foreign Assets

The central bank also earned 68 billion rupees on its foreign reserves. In 2024 foreign assets turned positive amid deflationary policy.

In 2023 the central bank paid 142 billion rupees in interest and earned only 86 billion on its reserves resulting in a negative carry.

The central bank borrowed dollars abroad through swaps effectively printing money to suppress rates. The central bank also borrowed from India as forex shortages emerged from its domestic assets purchases.

It also has a loan from the IMF, it borrowed after cutting rates through inflationary policy to create a crisis in 2015/2016. However over 2023 and 2024 the central bank has repaid India a part of the loans and continued to make repayments to the IMF.

Sri Lanka’s current IMF loan is given to the government as a budget support loan which can be used to repay debt.

In rupee terms there was a 140 billion rupee gain on negative foreign assets as the currency appreciated in 2023.

In 2024 however the central bank’s interest and gains on the foreign asses were 110 billion rupees as it built up foreign assets and expenses were only 83 billion rupees.

The central bank reported 274 billion rupees of profits after charging 22 billion rupees in operating expenses.

Central bank’s operating expenses, in general, are also inflationary as are profit transfers, which may lead to exchange rate pressure.

Salaries and wages went up steeply to 10.5 billion rupees from 7.5 billion rupees. Pension fund costs were 4.7 billion rupees, compared to a reversal of 3.9 billion rupees last year. (Colombo/Apr30/2025)