Sri Lanka financial VAT surges as taxes overshadow retained profits in banks

- CNL Reporter

- May 17, 2025

- Banking and Financial

- financial VAT

- 0 Comments

Sri Lanka’s collection of financial VAT charged mainly on banks have surged over 400 percent to 40.4 billion rupees in the first quarter of 2025 from 9.3 billion rupees last year, a Finance Ministry Report shows.

Financial VAT is an unusual tax, which is not invoiced to customers of banks directly but is charged on the value added within a firm. A large component is made up wages.

After a currency crisis from inflationary rate cuts and also income tax hikes of workers, banks were among the first to raise salaries.

Banks also saw an exodus of senior staff to foreign countries after the income tax hikes.

Sri Lanka had to raise income tax to pay the salaries of public service which had been especially after the war with graduates of state universities who could not get work in productive sectors and were given taxes collected from the people.

Salaries of state workers have been raised from April 2025.

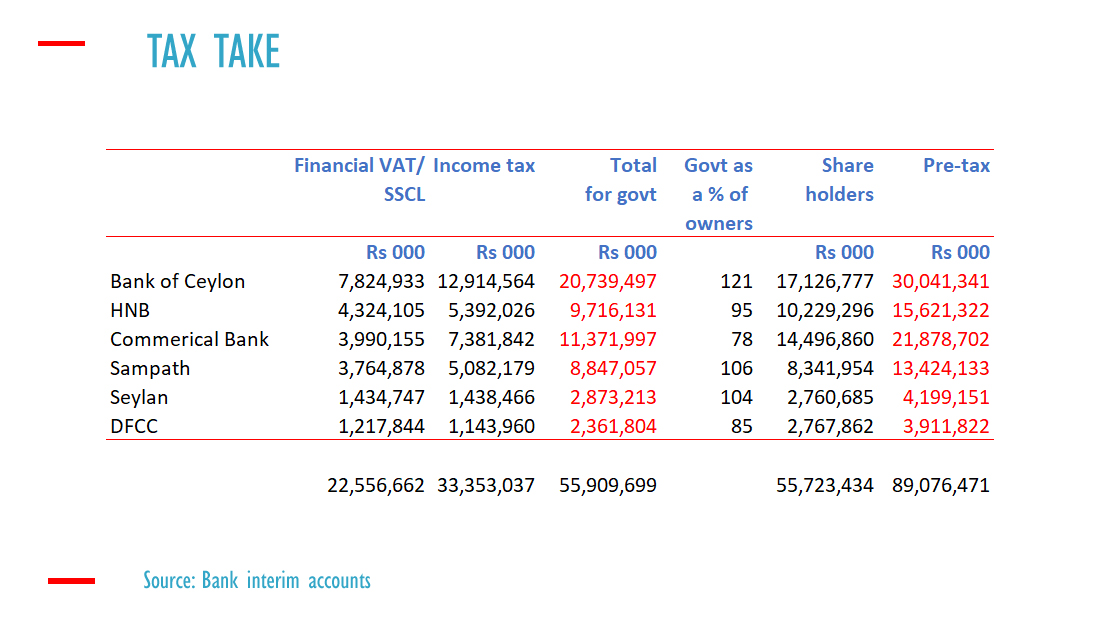

In the first quarter of 2025, published results of banks which have issued shares or bonds in the Colombo Stock Exchange show that, the government got more money from taxes than the shareholders in the case of some bank.

Most of the net profit is not distributed to shareholders as dividends but is left within the as capital to protect depositors as a buffer.

Some banks declared stock dividends, meaning they were effectively re-taken as shares to boost capital and net assets.

The financial VAT works in the same way as income tax as it is not directly invoiced to customers as in the retail or manufacturing VAT.

In the first quarter, the government has taken about 55.9 billion rupees as income and financial service taxes from banks while shareholders got 55.7 billion rupees.

Banks that have more staff may end up paying higher financial VAT.

The taxes on financial services included a social security contribution levy, a new tax that was introduced after the last currency crisis from rate cuts which ended in default.