Sri Lankan online shoppers stick to cash on delivery amid digital payment hesitation

- CNL Reporter

- May 2, 2025

- Business News

- online shoppers

- 0 Comments

52 % of Sri Lankan online shoppers prefer COD, up from 48 % in the previous year

Digital payment methods such as e-wallets lag 1 percent or less

Despite global shifts toward digital transactions, Cash on Delivery (COD) remains the dominant payment method for online shopping in Sri Lanka, according to the Digital Outlook Sri Lanka 2025 Report by the Asia Pacific Institute of Digital Marketing (APIDM) and the University of Kelaniya.

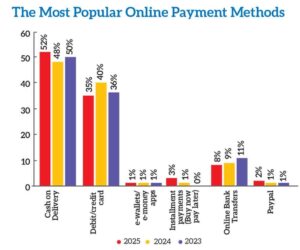

The report reveals that 52 percent of Sri Lankan online shoppers prefer COD, up from 48 percent in the previous year, underscoring persistent consumer caution toward digital payments.

While debit/credit card usage has dipped slightly to 35 percent (from 39.5 percent last year), newer digital payment methods such as e-wallets/e-money apps lag at 1 percent or less. Installment-based “Buy Now, Pay Later” options account for 3 percent, reflecting modest traction. Online bank transfers, meanwhile, accounted for 8 percent (down from 9 percent last year).

The trend contrasts with international markets, where digital wallets and card payments dominate. The report identifies multiple factors behind Sri Lanka’s COD reliance, including risk mitigation, cancellation flexibility, and avoiding fees and data sharing.Many fear potential online scams and fraud will loom large, with 70–80 percent of mid-range beauty product orders relying on COD while shoppers favour COD’s “no-commitment” approach. The COD method also allows them to reject orders upon delivery. In addition, consumers and suppliers avoid transaction charges via COD method and hesitate to share card details due to security concerns. WebLife Stores LLC (USA) E-Commerce Search Marketing Manager Saduka Sachintha noted that even tech-savvy sectors struggle with digital adoption.

“If you’ve used an online taxi here, you’ve heard drivers ask, ‘Cash or Card?’ This reflects a system still rooted in offline habits,” he explained While COD drives sales, particularly for top-purchased categories such as clothing (43 percent), personal care (23 percent), and electronics (22 percent), it complicates returns and cancellations for businesses.

Meanwhile, social media plays a pivotal role in product discovery, with 82 percent of shoppers relying on peer reviews and 63 percent influenced by endorsements from influencers. Yet, these digital engagements haven’t translated to payment method shifts.

To bridge the gap, the report urges collaborative efforts such as stronger regulations, financial literacy campaigns, and stakeholder collaboration.

“E-commerce should simplify life, not complicate it,” Sachintha emphasised. “Adoption requires proving there’s no viable alternative—like Sri Lanka’s fuel QR system, which succeeded because it was the only option.”

As Sri Lanka’s digital economy grows, overcoming cash dependence will largely hinge on addressing these deep-seated consumer anxieties while balancing convenience and security.

By Nishel Fernando