EPF net worth soars to Rs. 4.37 tn as real returns hit decade high

- CNL Reporter

- April 21, 2025

- News

- EPF

- 0 Comments

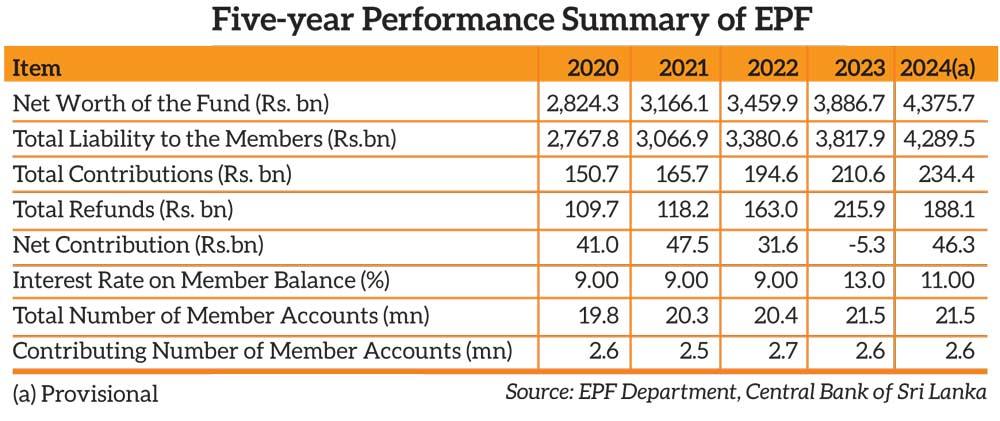

Sri Lanka’s Employees’ Provident Fund (EPF), the nation’s largest retirement fund, reported a record 12.6 percent year-on-year surge in net worth to Rs. 4.37 trillion by the end of 2024, up from Rs. 3.89 trillion in 2023. The growth was driven by robust investment income and higher contributions.

The Central Bank’s Governing Board approved an 11 percent nominal interest rate for 2024, down from 13 percent in 2023. However, deflation of 1.7 percent in 2024 pushed the real interest rate to 12.7 percent, up from 9 percent in 2023. This marked the first double-digit real return in recent history which contrasts sharply with 2021 and 2022, when inflation eroded returns, leaving EPF members with negative real yields.

The 11 percent interest rate remains subject to final approval by the Minister of Labour and Minister of Finance.

EPF’s total investment income climbed 6.8 percent to Rs. 513.8 billion in 2024, up from Rs. 481.1 billion the previous year. Interest income, the fund’s primary revenue source, grew 2.9 percent to Rs. 455.1 billion, while dividend income skyrocketed 82.9 percent to Rs. 5.5 billion. In particular, gains from listed equities also surged, with net fair value gains hitting Rs. 49.2 billion, more than double of 2023’s Rs. 23.8 billion.

Member contributions rose 11.3 percent YoY to Rs. 234.4 billion, and refunds dropped 12.9 percent to Rs. 188.1 billion. This resulted in a net contribution of Rs. 46.3 billion, reversing 2023’s net outflow of Rs. 5.3 billion.

Simultaneously, liabilities to members grew 12.4 percent to Rs. 4.29 trillion.

Operating expenses remained stable at 0.6 percent of gross income, but tax expenses jumped to Rs. 64.1 billion due to higher investment returns.

The EPF continued to dominate Sri Lanka’s superannuation sector, accounting for the mammoth share of 81 percent of total assets by end-2024.

By Nishel Fernando